modified business tax nevada instructions

Tax Foundation is Americas leading independent tax policy resource providing trusted nonpartisan tax data research and analysis since 1937. TurboTax Business is recommended if your small business is a partnership S Corp C Corp multi-member LLC or for trusts and estates.

Small Business Certification Required on all Preferential Sales of Set-aside Timber 5430-001.

. Of business notify a nevada department of taxation district office immediately. Follow our instructions line by line to file Form 1040 on paper or electronically. You were a Maine resident during any part of the tax year.

3 7 THIS PAGE INTENTIONALLY LEFT BLANK 8 Arizona Form 140 2021 Resident Personal Income Tax Return For information or help call one of the numbers listed. Gross income from a business means for example the amount on Schedule C line 7 or Schedule F line 9. SignNow has paid close attention to iOS users and developed an application just for them.

While there are many ways to show how much is collected in taxes by state governments the Index is designed to show how well states structure their tax systems and provides a road map for. 1 I Am Applying For. Form 1040 Line by Line Instructions.

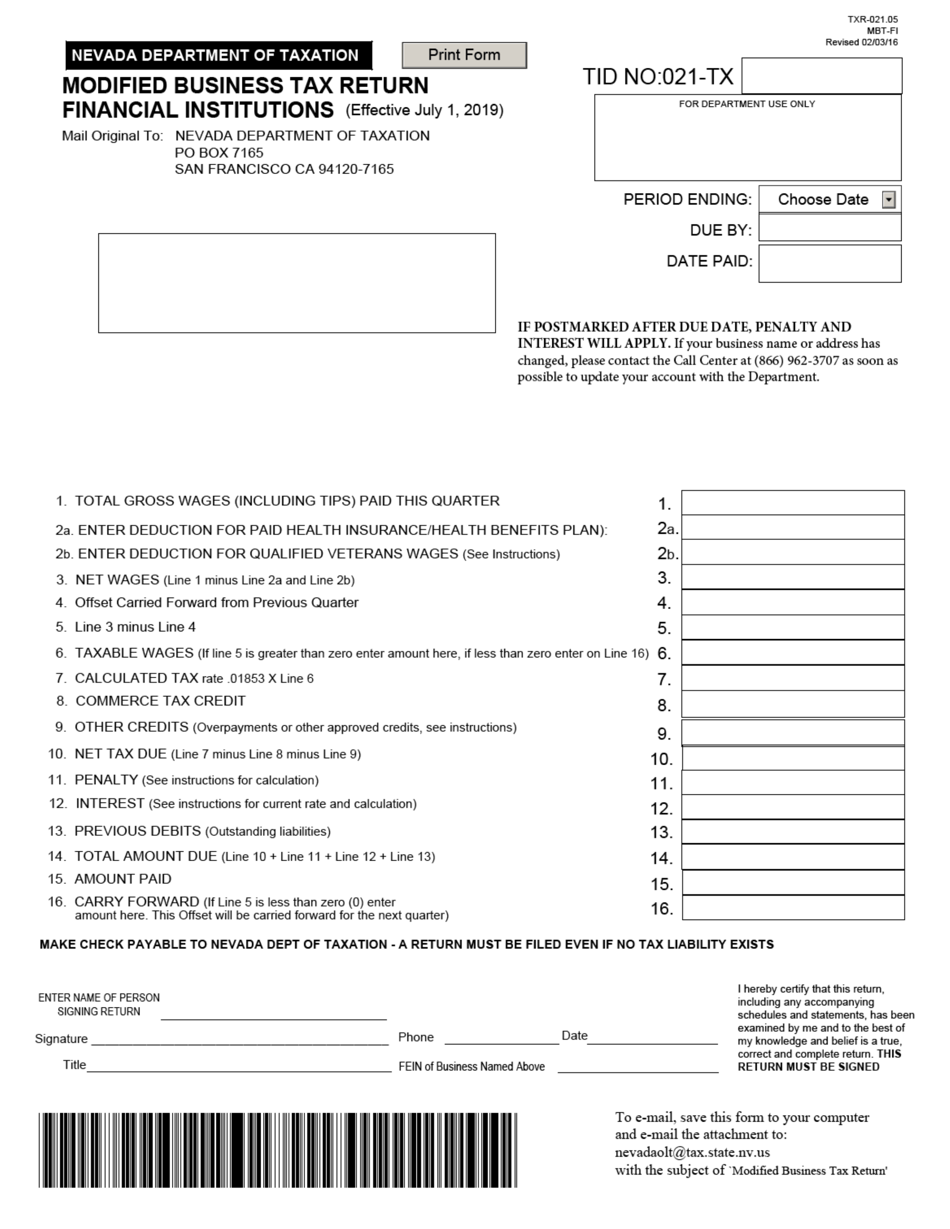

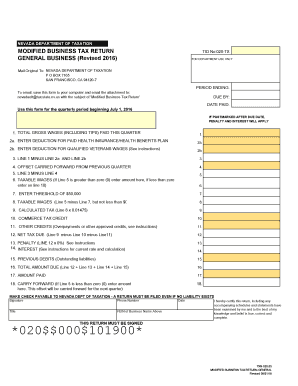

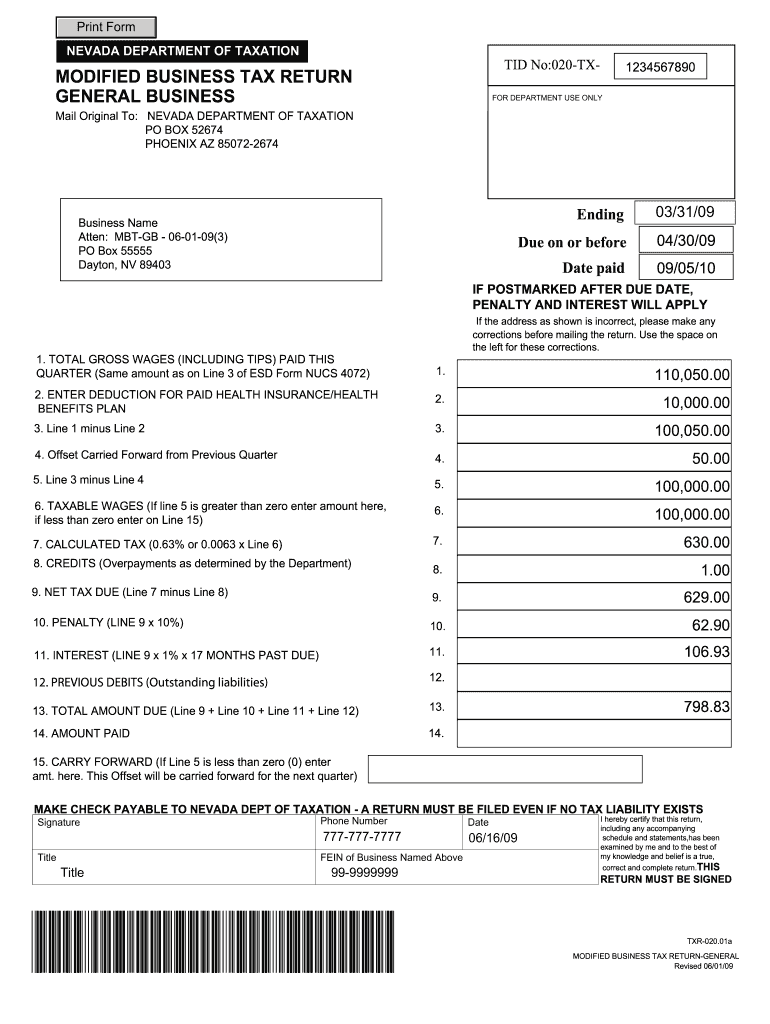

1 I Am Applying For. Or the Commerce Tax credit. For additional questions about the Nevada Modified Business Tax see the following page from the State of Nevadas Department of Taxation.

January 1 2000 Enclosed are the 2000 BPOL Guidelines for the Business Professional and Occupational License BPOL Tax. Use Form 1120-W Estimated Tax for Corporations as a worksheet to compute estimated tax. Nevada Department of Taxation PO Box 7165 San Francisco CA 94120-7165.

As long as you have the tax documents that is necessary you file a tax return it shouldnt take you more than half an hour to file Form 1040. Legislation enacted by the General Assembly in 1996 directed that the BPOL Guidelines be updated triennially to provide a current interpretation of Code of Virginia 581-3700 et seqThis edition incorporates the statutory and. Jan 2018 Deposit Bid for Timber and other Vegetative Resource Sales 5450-003.

NEVADA BUSINESS REGISTRATION Please see instructions regarding form detail and online registration options. Register for an EAN online at the DETRs Employer. If a or b applies see the instructions for lines 6a and 6b to figure the taxable part of social security benefits you must include in gross income.

TurboTax is tailored to your unique situation-it will search for the business deductions and credits you deserve TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations so you. Nevada DETR Employer Account Number. If postmarked after due date penalty and interest will apply a return must be filed even if no tax liability exists sales tax enter amounts in county of salesuse or county of delivery total sales tax calculation formula column a use tax exempt sales taxable sales tax rate - column b column c x column.

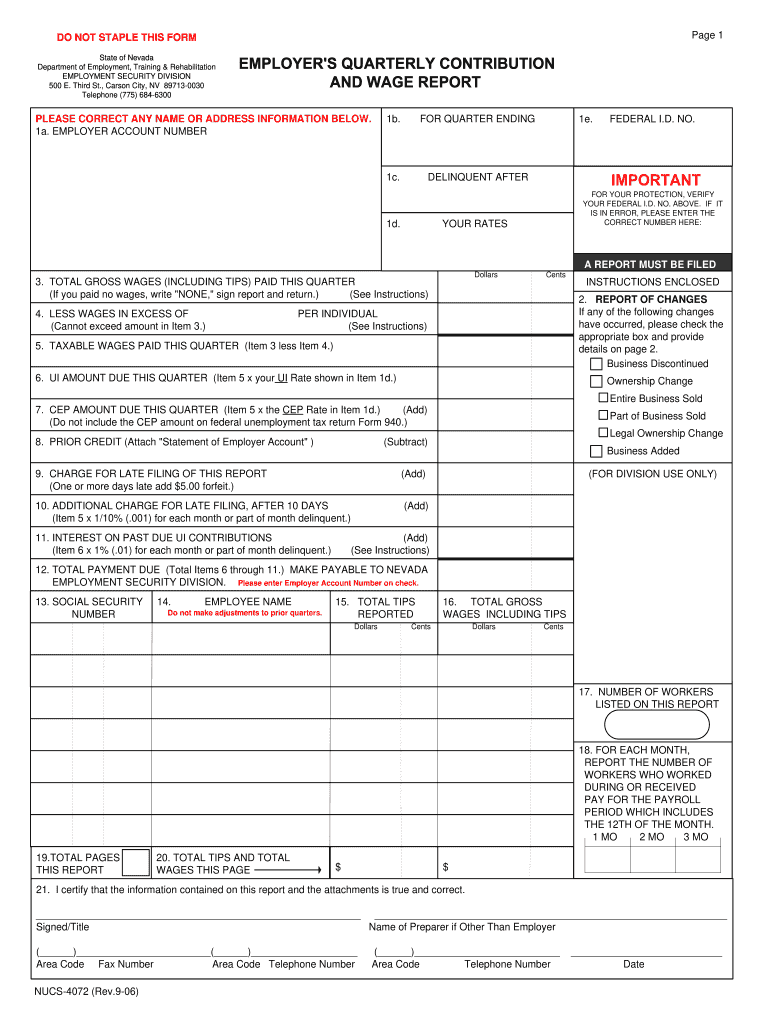

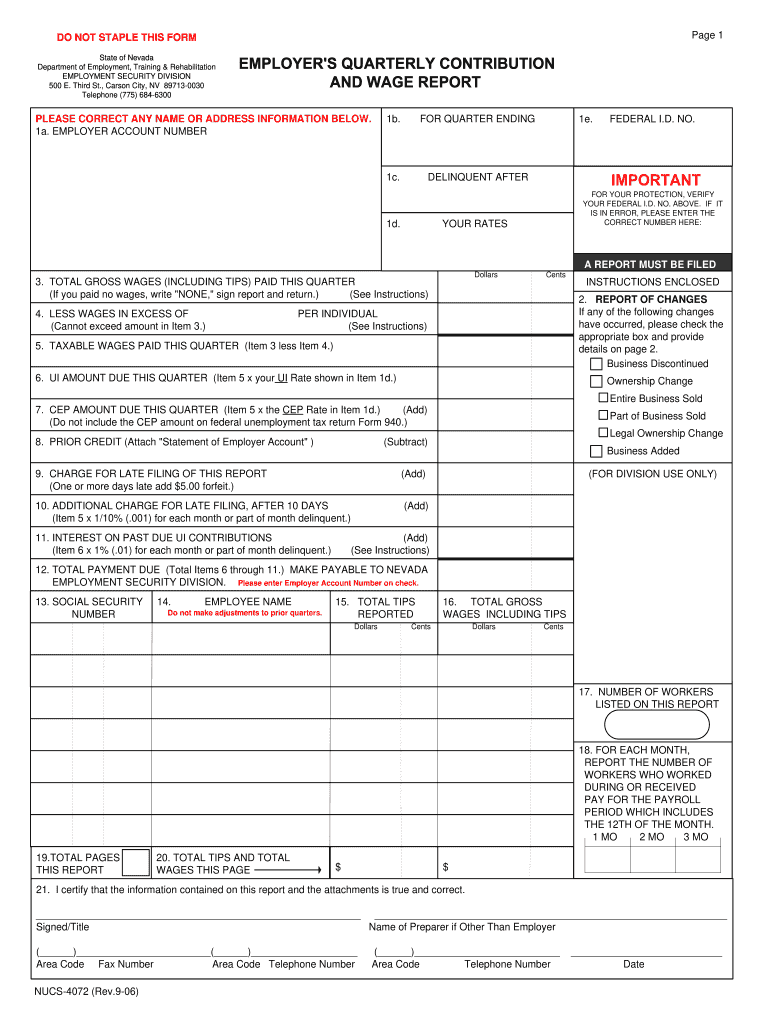

Employers who pay employees in Nevada must register with the NV Department of Employment Training and Rehabilitation DETR for an Employer Account Number and Modified Business Tax MBT Account Number. If any date falls on a Saturday Sunday or legal holiday the installment is due on the next regular business day. May 1965 Self Certificate Clause Bidders Statement 5430-011.

Below we do a walkthrough of filling out the PTC form and we simplify the terms. Form 8962 Premium Tax Credit PTC is the form you will need to report your household Modified AGI MAGI your Federal Poverty Level amount your familys health insurance premium exemptions and the cost assistance you received. No just filed once.

Modified Business Tax. SEND A COPY TO EACH AGENCY Unemployment Insurance Employment Security Division - ESD SalesUse Tax Permit Modified Business Tax Department of Taxation Local Business License. Initial Business Privilege Tax Return Form BPT-IN Amount due.

On May 13 2021 the Nevada Supreme Court upheld a decision that Senate Bill 551 which was passed during the 2019 Legislative Session. Instructions below are updated for the 2021 tax season. 9 PROPERTY TAX FAIRNESS CREDIT Form 1040ME line 25d You may qualify for a refundable Property Tax Fairness Credit up to 750 1200 if you are 65 years of age or older if you meet all of the following.

Gross income includes gains but not losses reported on Form 8949 or Schedule D. NEVADA BUSINESS REGISTRATION Please see instructions regarding form detail and online registration options. Phoenix 602 255-3381 From area codes 520 and 928 toll-free 800 352-4090 Tax forms instructions and other tax information If you need tax forms instructions and other tax information go to the.

Account Numbers Needed. For Out-of-State Charitable Organizations Not Required to do Business in Nevada Required for any Charitable Organization that intends to solicit charitabletax deductible contributions in Nevada. 25 months after LLC formation.

Tax credits are based on income and cap your monthly premium between roughly 2 and 95 adjusts each year. Nov 2011 Independent Price Determination Certificate 5440-009. If you are using Chrome.

Detailed instructions are included in the complete packet for each type of filing. The installments are due by the 15th day of the 4th 6th 9th and 12th months of the tax year. See the Instructions for Form 1120-W.

Additional information can be found in FTB Pub. The Tax Foundations State Business Tax Climate Index enables business leaders government policymakers and taxpayers to gauge how their states tax systems compare. The formation date is the date next to.

1001 Supplemental Guidelines to California Adjustments the instructions for California Schedule CA 540 California Adjustments - Residents or Schedule CA 540NR California Adjustments - Nonresidents or Part-Year Residents and the Business Entity tax booklets. All new LLCs must file an Initial Business Privilege Tax Return and pay the business privilege tax within 25 months of their formation. What You Need to Know about Form 8962.

SEND A COPY TO EACH AGENCY Unemployment Insurance Employment Security Division - ESD SalesUse Tax Permit Modified Business Tax Department of Taxation Local Business License. For 2021 plans it is 207 and 986 see the form 8962 instructions for the numbers for more information of your total household Modified Adjusted Gross Income MAGI per household member AKA household income. You owned or rented a home in Maine during any part of the tax year and lived in that home as your principal.

How to create an electronic signature for the Nevada Modified Business Tax Return Form on iOS devices nevada modified business returnne or iPad easily create electronic signatures for signing a nevada modified business tax form 2021 in PDF format.

Nevada Opportunity Scholarships How They Work Nevada Action For School Options

Form Nucs 4072 Fill Online Printable Fillable Blank Pdffiller

Incorporate In Nevada Do Business The Right Way

Form Txr 021 05 Mbt Fi Download Fillable Pdf Or Fill Online Modified Business Tax Return Financial Institutions Nevada Templateroller

Modified Business Tax Return Form Nevada Fill Online Printable Fillable Blank Pdffiller

Nevada Modified Business Tax Return Fill Online Printable Fillable Blank Pdffiller

How To File And Pay Sales Tax In Nevada Taxvalet

Corporate Tax Return Due Date 2019

Nevada Modified Business Tax 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

Modified Business Tax Return Form Nevada Fill Online Printable Fillable Blank Pdffiller